- Insider Authority

- Posts

- 👀 Follow the Footprints: ONMD Insiders Just Made a Coordinated Strike.

👀 Follow the Footprints: ONMD Insiders Just Made a Coordinated Strike.

With the shortened holiday trading week, volumes thinned out and price action stayed muted. Even in the lighter tape, markets still saw pockets of volatility as traders positioned into month-end. Amid the quiet, ONMD’s insider cluster buying stood out as one of the strongest conviction signals of the week.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending November 28, 2025

The week closed on a strong note: S&P 500 rose ~3.7%, Dow Jones Industrial Average gained ~3.2%, and Nasdaq Composite jumped ~4.9%.

Small-cap stocks outperformed: the Russell 2000 surged ~5.5% on the week.

On the month overall, markets ended November with modest gains — the S&P eked out about +0.1%.

🔑 Key Drivers & Dynamics

Rate-cut optimism fueled rallies. Growing expectations that the Federal Reserve might begin cutting interest rates helped lift risk sentiment.

Rotation beyond mega-cap tech. After a rough November for AI and big-tech names, strength resurfaced in broader sectors — boosting small caps and value/cyclical plays rather than just tech.

Holiday-week trading + infrastructure hiccup. The week was shortened by holiday trading hours, and markets also digested a brief but impactful outage at a major derivatives exchange operator.

🧭 Key Takeaways

Broad strength = healthy breadth. With most sectors advancing and small caps leading, the rally looked more broad-based than November’s narrow tech-led moves.

Fed expectations remain the key catalyst. Rate-cut odds are keeping risk-on sentiment alive — any shift in tone from the Fed could rapidly change the landscape.

Rotation matters. With tech cooling off and other sectors picking up steam, bottom-up stock-selection could outperform blind bets on mega-cap growth.

Volatility isn’t gone. Even in a strong rally, the data-center outage reminded markets that structural risks and liquidity quirks can still rattle sentiment.

Seasonality + positioning may fuel next leg. The year-end window, combined with inflows and rate optimism, could give a lift — but only if macro and earnings align.

Insider spotlight of the week…#ONMD

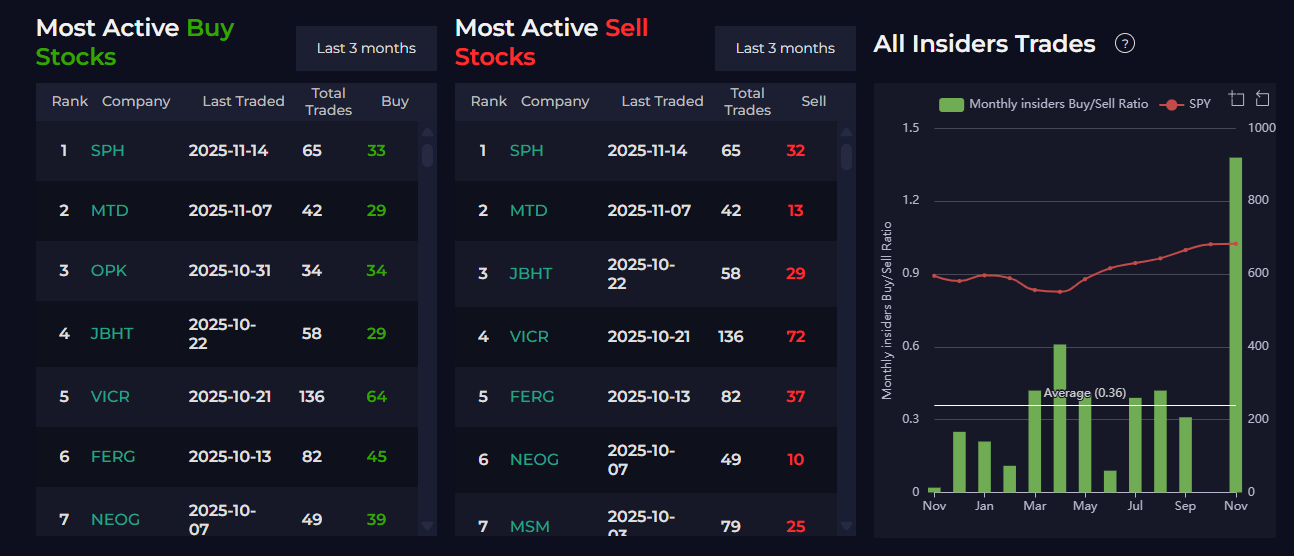

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’