- Insider Authority

- Posts

- Grinding Sideways - Market Briefing | 11 Nov 2025

Grinding Sideways - Market Briefing | 11 Nov 2025

Remembrance Day – Honoring The Fallen And Those Who Serve

Today’s markets seem just like yesterday’s and last week’s in that we are grinding sideways with no new ground being won or lost.

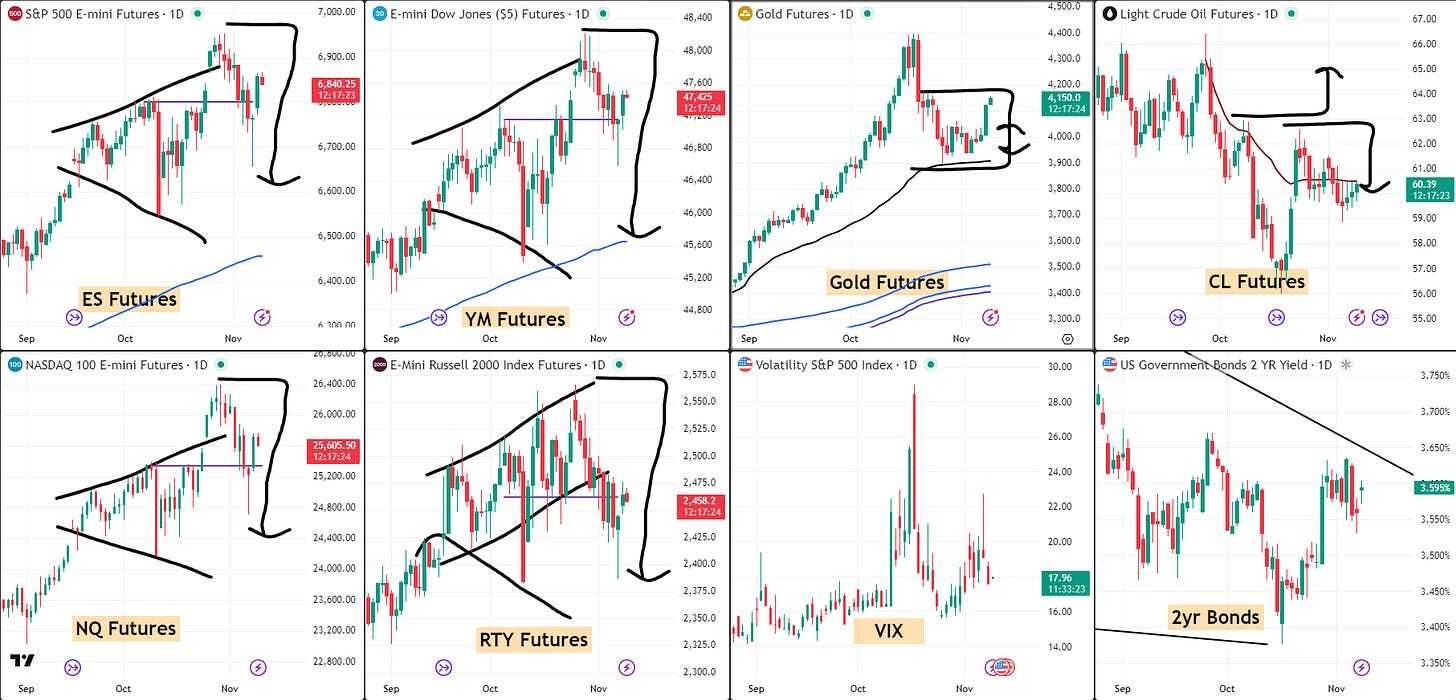

The daily charts look like nothing serious has happened – and yet yesterday did see a 100+ point move on the ES and comparative moves on NQ and YM. RTY was the only wobble, which again may offer clues as to the real moves unfolding behind the exuberance of the blue chip leaders.

Gold is already leading the charge to reclaim some ground, and I’m already seeing this move being talked about in terms of this being a bull trap and further capitulation moves.

I’m not in the forecasting or crystal ball game. I respond to what my system is saying, and I always have firm over/under lines – so as to not get caught in a trap… with no way out.

SPX has pushed firmly off Friday’s lows and is near the upper Bollinger Band. Should we not reach it, I will use the AVWAP from the TnT low as a moving level I can manage my bull swing as needed.

RUT also behaving in a similar way off Friday’s low – but struggling to push higher to the same magnitude. It is finding overhead resistance at the AVWAP from the TnT high, again using the AVWAP off TnT low as line to manage the bull positions without waiting for the PFZ level to be tripped.

Keep scrolling for the systematic grinding sideways analysis…

100+ ES Move Looks Like Nothing On Daily. RTY Wobble Tells Different Story.

SPX. 30 Minutes. One Trade. Job Done.

Trade less. Profit more. This isn’t trading… it’s income engineering.

SPX Market Briefing:

Tuesday November observes Remembrance Day honoring the fallen whilst markets grind sideways (no new ground won/lost despite yesterday’s 100+ ES move looking uneventful on daily charts), RTY wobble offering clues to real moves behind blue chip exuberance as gold leads reclaim with bull trap talk emerging, Phil responding to system not forecasts using firm over/under lines and AVWAP from TnT levels for management rather than waiting for PFZ trips.

Current Multi-Market Status:

ES: 6840.25, near upper Bollinger Band off Friday lows

RTY: 2458.2, struggling vs blue chips, wobbling

YM: 47,425, comparative move to ES yesterday

NQ: 25,605.50, blue chip exuberance continuing

CL: $60.39, reclaimed $60 level

GC: $4150.0, leading charge to reclaim ground

VIX: 17.96, declining from elevated levels

2yr Bonds: 3.595%

Remembrance Day – A Minute To Honor

Let’s take a minute to bow our heads and remember the fallen and for those that serve on a day of remembrance.

11 November – A moment to pause from markets and trading to honor those who gave their lives and those who continue to serve.

The systematic approach to trading provides freedom and flexibility – including the freedom to step away, honor what matters, and return to mechanical execution when appropriate.

Today we remember.

Grinding Sideways – 100+ ES Move Looks Like Nothing

Today’s markets seem just like yesterday’s and last week’s in that we are grinding sideways with no new ground being won or lost.

The daily charts look like nothing serious has happened. Pull up SPX, ES, NQ, YM – they all show ranging, grinding, sideways consolidation. No decisive breakouts. No confirmed reversals.

And yet yesterday did see a 100+ point move on the ES and comparative moves on NQ and YM.

Timeframe perspective:

Intraday traders: “Massive 100+ point move! Volatility! Action!”

Daily chart observers: “Meh. Another inside bar. Still ranging.”

For systematic traders, daily charts matter more than intraday volatility when assessing directional conviction. If daily charts aren’t confirming moves, intraday drama is just noise.

Current Status: Grinding sideways with no new ground won/lost, 100+ ES move looks uneventful on daily timeframes

RTY Wobble – Blue Chip Exuberance Lacks Foundation

RTY was the only wobble, which again may offer clues as to the real moves unfolding behind the exuberance of the blue chip leaders.

ES, YM, NQ: All pushing off Friday lows. Blue chip exuberance. Grinding higher.

RTY: Wobbling. Not keeping pace. Struggling with same magnitude.

When blue chips are exuberant but small caps are wobbling, this suggests surface-level strength without broad-based conviction. Blue chip names can rally on their own momentum, but if small caps aren’t participating, the move lacks foundation.

RUT finding overhead resistance at AVWAP from TnT high whilst SPX approaches upper Bollinger Band. Divided market behavior.

Current Status: RTY wobbling whilst blue chips exuberant, small cap weakness suggesting surface-level strength

System Response Not Forecasting

Gold is already leading the charge to reclaim some ground. GC: $4150.0 – pushing higher after recent weakness.

And I’m already seeing this move being talked about in terms of this being a bull trap and further capitulation moves.

I’m not in the forecasting or crystal ball game. I respond to what my system is saying.

And I always have firm over/under lines – so as to not get caught in a trap… with no way out.

Firm over/under lines = mechanical levels:

Above = bullish positioning appropriate

Below = bearish positioning appropriate

Price moves, positioning adjusts, never trapped

Current Status: Gold leading with competing narratives, responding to system with firm lines preventing traps

AVWAP Management – Tighter Control Without PFZ Wait

SPX has pushed firmly off Friday’s lows and is near the upper Bollinger Band.

Should we not reach it, I will use the AVWAP from the TnT low as a moving level I can manage my bull swing as needed.

Enhanced approach: Use AVWAP from TnT low as dynamic management level. Don’t wait for PFZ trip. AVWAP provides dynamic support that moves with price. Break below signals weakness before PFZ level trips. Tighter management in uncertain environment.

RUT also behaving in a similar way off Friday’s low – but struggling to push higher to the same magnitude.

It is finding overhead resistance at the AVWAP from the TnT high, again using the AVWAP off TnT low as line to manage the bull positions without waiting for the PFZ level to be tripped.

Two AVWAP levels on RUT:

AVWAP from TnT high: Overhead resistance (price struggling)

AVWAP from TnT low: Support/management level (exit if breaks)

Price squeezed between two AVWAPs creates defined risk zone. Tighter management than waiting for PFZ trip.

Current Status: SPX near upper BB using AVWAP from TnT low for management, RUT squeezed between two AVWAP levels

First time sitting down properly this week: Monday was weekend, today (Tuesday) is first proper desk session. Looking for Premium Popper opportunities after being away.

The advantage of systematic frameworks: They don’t require constant monitoring. Premium Poppers have mechanical entry triggers. When setups appear, execution happens. When they don’t, patience continues.

Being away from desk doesn’t create FOMO or anxiety when systems are mechanical. Just return, scan for setups, execute if triggered, continue if not.

Current Status: Back at desk, scanning for Premium Popper opportunities, systematic patience no FOMO

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System(includes 7 mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!