- Insider Authority

- Posts

- 👀 J.B. selling, not buyin'

👀 J.B. selling, not buyin'

Markets hit a pause button this week as earnings season intensified, volatility picked up, and leadership continued to rotate beneath the surface. Indexes chopped, conviction thinned, and traders were forced to get more selective with risk. And while headlines stayed focused on macro and mega-caps, JBHT insider selling quietly sent a message smart money was paying attention to.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending January 30, 2026

Market Performance

U.S. equities finished the week mixed to slightly lower as earnings uncertainty and rate sensitivity weighed on sentiment

The S&P 500 and Nasdaq struggled to hold recent highs, while the Dow and select value sectors showed relative resilience

Intraday volatility expanded as traders repositioned around earnings, Fed expectations, and upcoming economic data.

🔑 Key Drivers & Dynamics

📊 1. Earnings Reality Check

As more companies reported, markets shifted from optimism to scrutiny, rewarding realistic guidance and punishing uncertainty.

🎯 2. Rotation Continues Beneath the Surface

Mega-cap leadership faded while capital rotated into utilities, healthcare, and select cyclicals — signaling redistribution, not panic.

🏦 3. Rates Still Run the Show

Treasury yields continued to dictate sector performance, keeping pressure on growth stocks and supporting value-oriented names.

📉 4. Volatility Finds a Floor

Wider daily ranges suggested traders are repositioning rather than chasing momentum, favoring structure over speculation.

📌 Key Takeaways

🧠 This is digestion, not distribution

Markets are consolidating after strong runs, not showing signs of systemic breakdown.

🧠 Earnings now dominate price action

Stock selection matters more than index exposure as dispersion increases.

🧠 Insider selling deserves respect

JBHT’s recent transactions stand out as executives reduce exposure during uncertain conditions.

🧠 2026 positioning is accelerating

Institutional capital is becoming more intentional about sector and theme allocation.

👀 What We’re Watching Next Week

📅 Key Economic Data

Upcoming inflation and labor-market reports will be closely watched for confirmation that disinflation trends remain intact.

🏦 Fed Commentary & Rate Expectations

Any shift in tone from Fed officials could move yields and reset expectations around the pace of rate cuts.

📊 Peak Earnings Reports

Results from major technology, financial, and industrial names will shape near-term sentiment and sector leadership.

📉 Volatility & Key Technical Levels

With ranges expanding, key support and resistance zones on major indexes will be critical for short-term direction.

Insider spotlight of the week…#JBHT

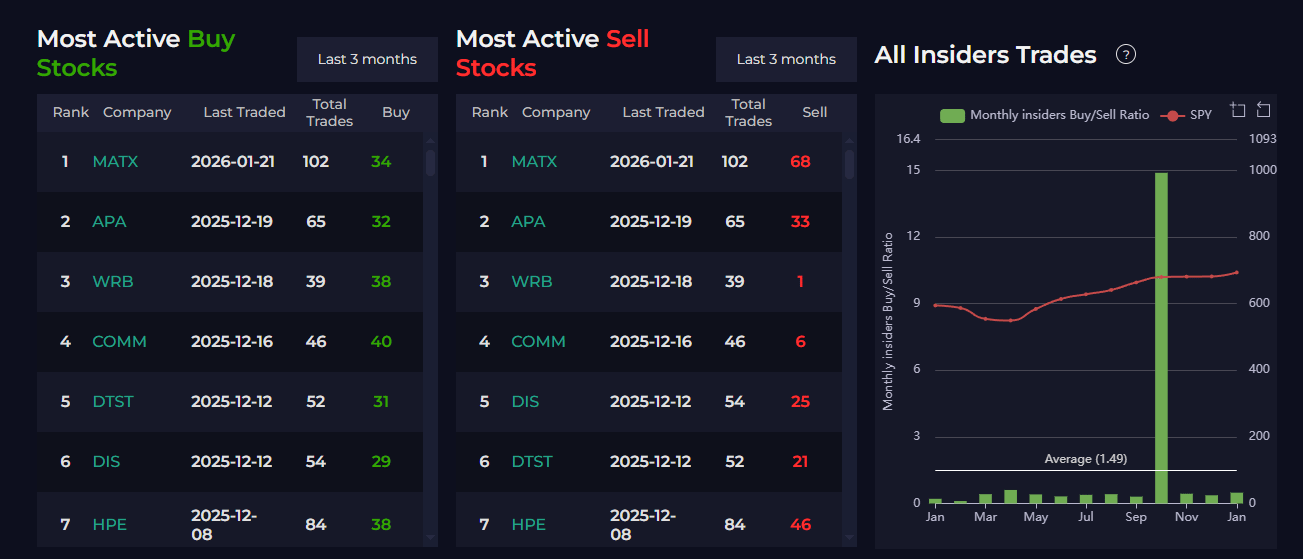

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’

P.S. Interested in joining hundreds of traders using our mechanical systems to generate consistent, long-term income all without wasting hours analyzing setups? Check out Option Income Project here.