- Insider Authority

- Posts

- 👀 Markets Shrug... OPK Insider Does Not.

👀 Markets Shrug... OPK Insider Does Not.

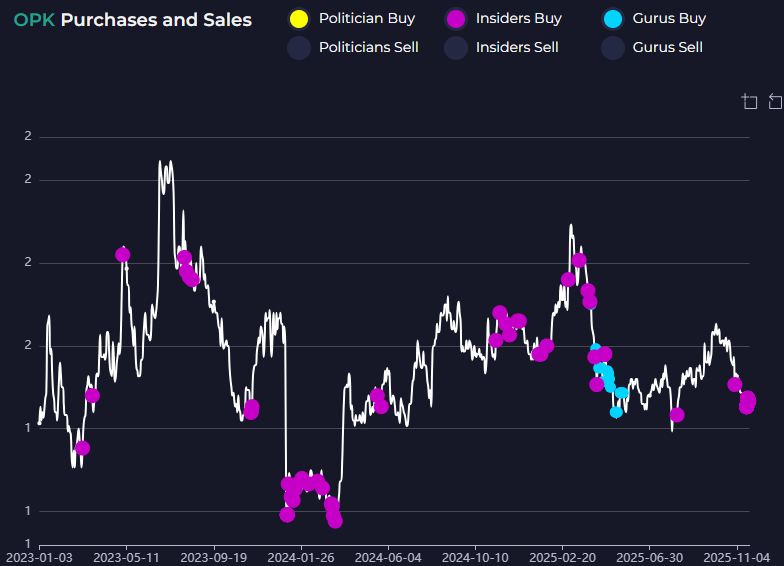

This week’s tape was a roller coaster, with rallies fading and dips snapping back in minutes. Volatility re-emerged as the dominant force, leaving traders on their toes. Yet amid the noise, $OPK’s insider made a bold purchase that stood out as one of the clearest signals of conviction.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending November 21, 2025

U.S. stocks closed the week in the red despite a late bounce: the S&P 500, Dow Jones Industrial Average and Nasdaq Composite all posted weekly losses.

The week was marked by sharp intra-day swings, especially in big tech and AI-related stocks, which sparked jitters on valuations and momentum.

Optimism around a potential December rate cut by the Federal Reserve provided some lift, but mixed economic data and consumer sectors’ weakness weighed on sentiment.

Fund flows remained positive: U.S. equity funds drew inflows for a fifth consecutive week, showing that despite turbulence, investor risk-appetite stayed intact.

🔑 Key Takeaways

Valuations under pressure: Big tech & growth stocks are being re-tested, and the market is showing cracks in momentum despite still solid fundamentals.

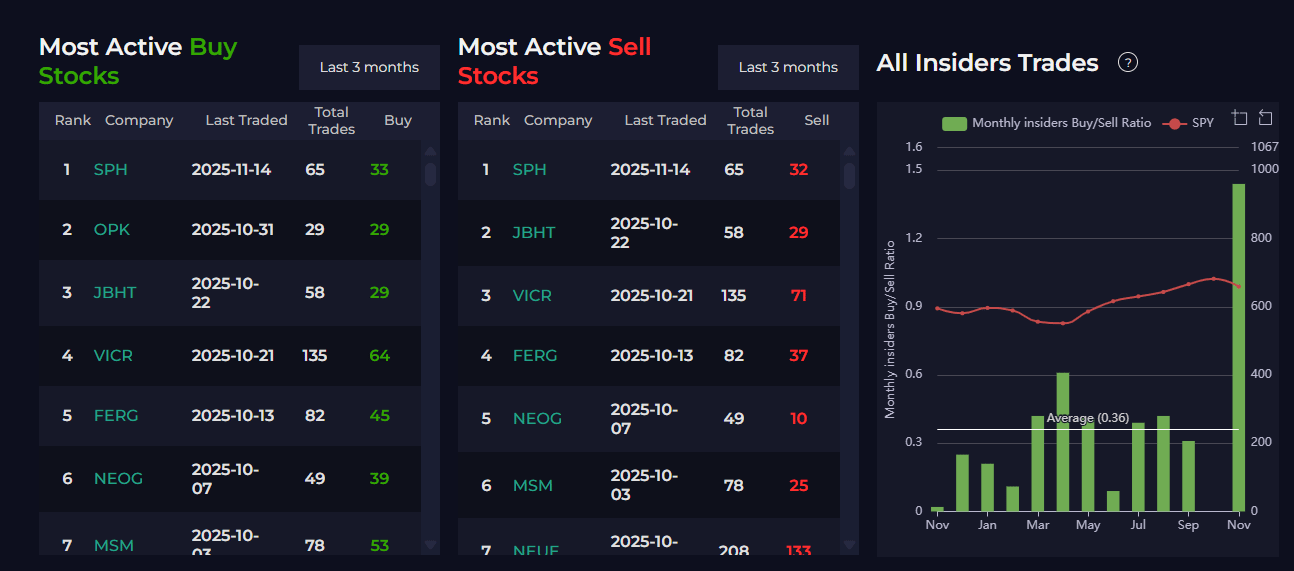

Insider signals matter: Even as the market stumbles, insiders are buying. That divergence can offer ahead-of-the-curve insight.

Rate path still unclear: Markets are reacting to every subtle Fed hint, making the next few weeks pivotal for interest-rate expectations.

Rotation may be underway: With tech underperforming, other sectors may start stealing the spotlight — value, energy, or industrials could come into focus.

Watch consumer nerves: Simultaneous weakness in both consumer-discretionary and consumer-staples sectors is a rare red-flag for the economy.

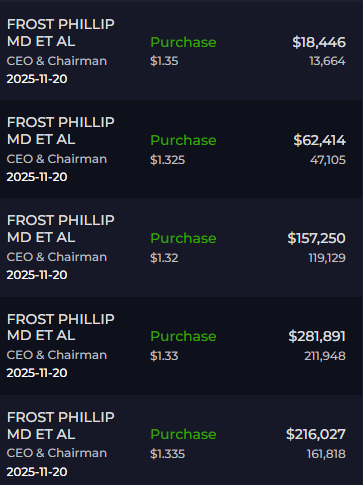

Insider spotlight of the week…#OPK

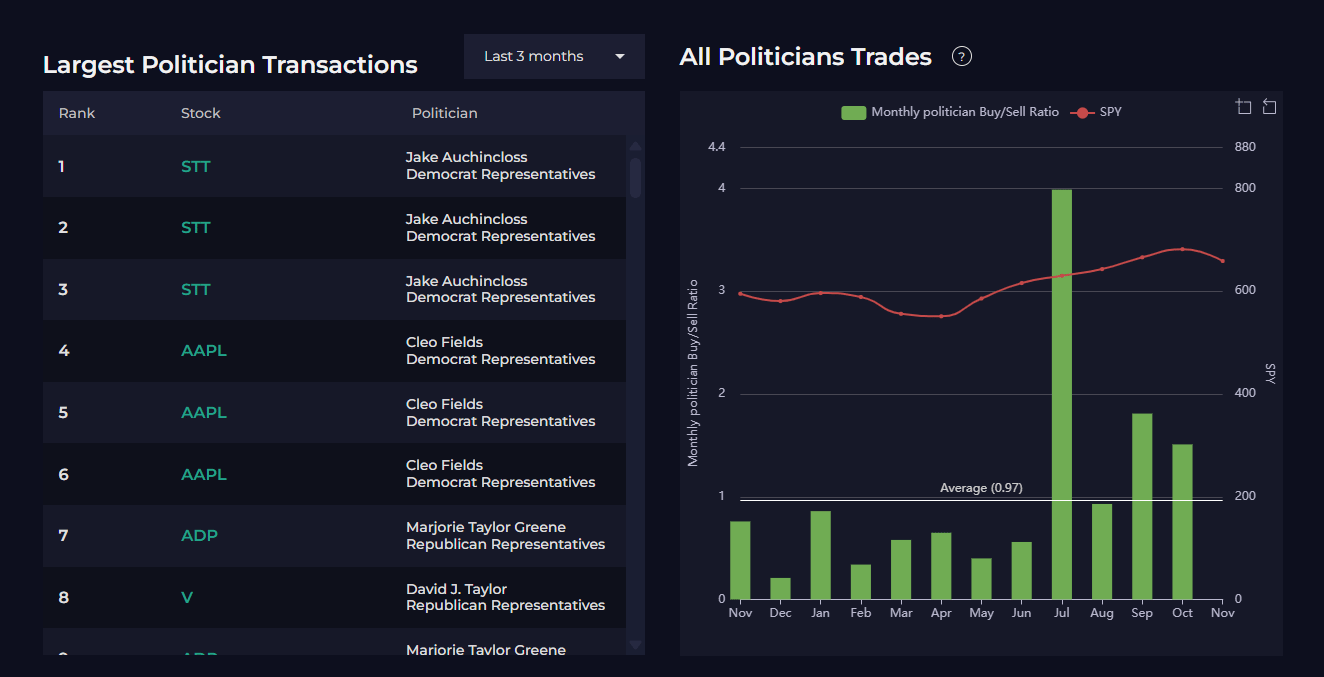

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’