- Insider Authority

- Posts

- 👀 Major Investor Quietly Ramps Up Its Bet

👀 Major Investor Quietly Ramps Up Its Bet

Markets stayed choppy this week as earnings season picked up and leadership continued to rotate beneath the surface. Volatility is rising, stock selection is starting to matter again, and early 2026 positioning is quietly taking shape. And while the tape hesitated, Mawson Infrastructure (MIGI) insiders were buying — a smart-money signal worth paying attention to.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending January 23, 2026

Market Performance

U.S. equities finished the week mixed as markets digested early earnings, shifting rate expectations, and renewed sector rotation

Major indexes pulled back from recent highs, with the Nasdaq lagging while the Dow and select value sectors showed relative strength

Volatility picked up modestly as traders repositioned ahead of key economic data and the heart of earnings season.

🔑 Key Drivers & Dynamics

📊 1. Earnings Season Takes Center Stage

Early earnings reports drove sharp stock-level reactions, with guidance proving more important than headline beats or misses. Markets began repricing leadership as forward outlooks set expectations for Q1 and beyond.

🎯 2. Rotation Accelerates Beneath the Surface

Mega-cap tech cooled while capital rotated into financials, energy, and cyclicals — signaling redistribution rather than broad risk-off behavior.

🏦 3. Rates Remain the Market’s Compass

Treasury yields continued to influence sector performance, pressuring growth stocks while supporting value-oriented areas and dividend payers.

📉 4. Volatility Creeps Back In

Intraday ranges expanded as positioning adjusted and liquidity normalized, rewarding disciplined execution over momentum chasing..

📌 Key Takeaways

🧠 Leadership is shifting, not collapsing

Weakness in tech was met with strength elsewhere, suggesting rotation rather than structural breakdown.

🧠 Earnings now drive the tape

Stock selection is becoming more important as index trends flatten and dispersion increases.

🧠 Insider buying remains a high-signal input

ATLN’s accumulation stands out as executives step in while sentiment remains mixed.

🧠 2026 positioning is taking shape

Markets are increasingly focused on where capital wants to rotate next as the year’s dominant themes begin to emerge.

👀 What We’re Watching Next Week

📅 Key Economic Data

Upcoming inflation and employment readings will shape expectations around the pace and timing of future rate cuts.

🏦 Fed Speak & Rate Expectations

Any commentary from Fed officials could move yields — and with them, sector leadership and volatility.

📊 Earnings from Market Leaders

Results from major technology and financial names will set the tone for broader market sentiment and rotation trends.

📉 Volatility & Key Technical Levels

With ranges expanding, we’re watching whether major indexes hold recent support or test deeper consolidation zones.

Insider spotlight of the week…#MIGI

Here is a snapshot of last week’s recent insider activity…

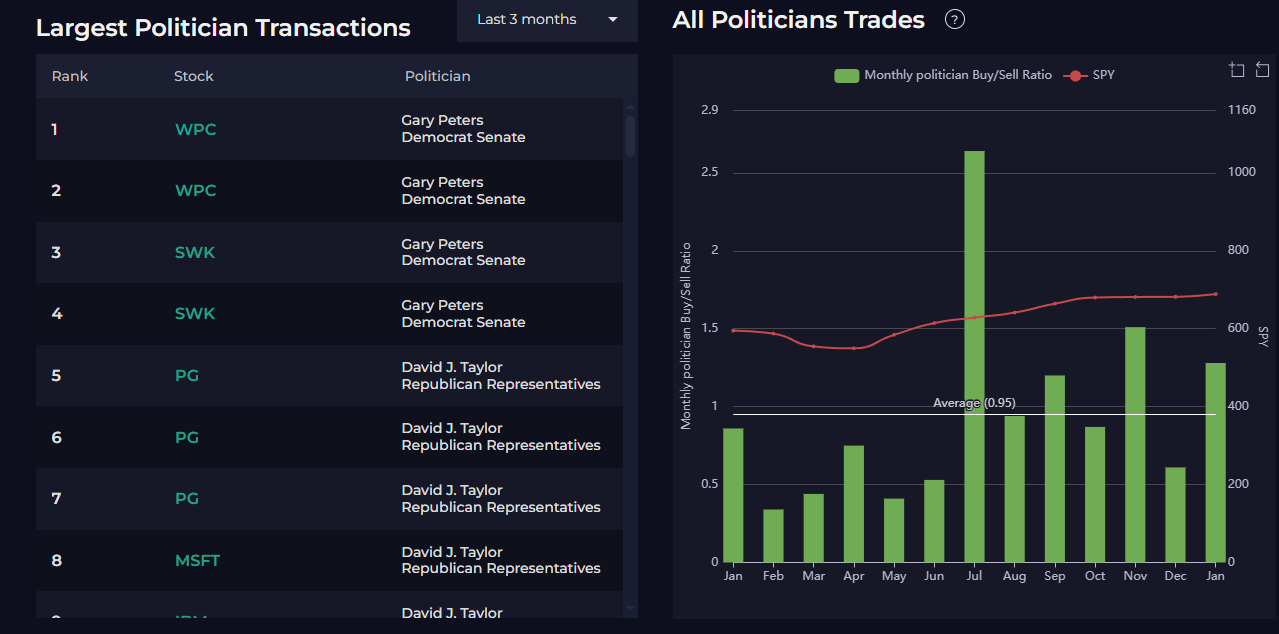

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’

P.S. Interested in joining hundreds of traders using our mechanical systems to generate consistent, long-term income all without wasting hours analyzing setups? Check out Option Income Project here.