- Insider Authority

- Posts

- 👀 OPEX Volatility Clears the Board... and TPVG Insiders Make Their Move

👀 OPEX Volatility Clears the Board... and TPVG Insiders Make Their Move

As the largest options expiration on record triggered volatility and forced positioning, TPVG insiders stepped in with aggressive cluster buying — a signal that confidence may be building beneath the surface as year-end approaches.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending December 19, 2025

Tech stock pullback: AI-linked names led Friday losses, dragging the Nasdaq and S&P lower — the worst session in 3 weeks as investor caution hit high-growth names amid rising Treasury yields. The Dow outperformed on the week.

Fed policy in focus: Anticipated rate cuts and dovish Fed messaging helped underpin broader markets earlier in the week, keeping hopes alive for more easing into 2026.

Small-cap strength: Russell 2000 extended gains, reflecting appetite for domestic-focused and value sectors.

Cross-sector breadth: Consumer & defense sectors held up better, even as tech wobbled — a sign of rotation beyond pure AI plays.

🔑 Key Drivers & Dynamics

📊 1. Tech & AI Stocks Rekindle the Rally

Tech and AI-linked names led Friday’s charge, with heavyweight contributors like Nvidia and Broadcom powering gains as investor focus shifted back to high-growth sectors. The Nasdaq’s outperformance reflected renewed confidence in AI earnings potential after a rough patch earlier in the week.

📉 2. Inflation Comes in Cooler Than Expected

November’s CPI print showed inflation rising less than forecast — a softer 2.7% year-over-year — fueling optimism for further Fed easing in early 2026. This data point helped underpin risk assets and rekindle hopes for rate cuts after the Federal Reserve’s recent policy pivots.

🏦 3. Markets Digest Mixed Economic Signals

Despite the inflation beat, other economic data painted an ambiguous picture. Labor market indicators and retail figures offered uneven signals, prompting traders to question the robustness of growth and the timing of future monetary policy actions.

🌍 4. Global Market Momentum Continues

European equities, led by the FTSE 100’s climb on Friday, suggested risk appetite isn’t confined to U.S. markets. Central bank rate cuts abroad and weakening retail data in the UK added depth to the year-end rally narrative.

📥 5. Insider Buying Spotlight — TPVG

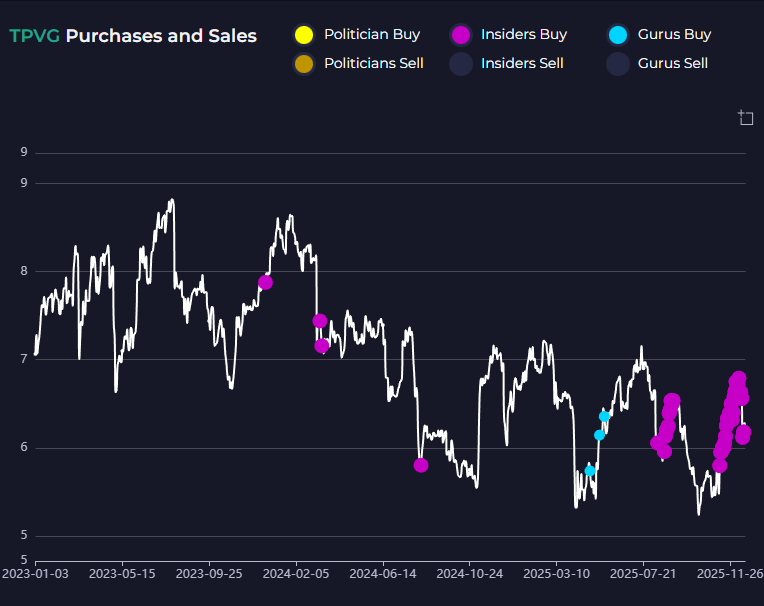

Notably, TriplePoint Venture Growth BDC (TPVG) saw continued insider accumulation. Director and executives have been steadily acquiring shares through 10b5-1 plans, signaling management confidence despite analyst skepticism and a modest valuation backdrop. This cluster of insider purchases — spanning mid-December transactions at prices near ~$6.18–$6.64 — stands out as a potential contrarian indicator worth watching.

📌 Key Takeaways

✔ Bulls Squeeze Out Year-End Gains

Major U.S. indices ended the week positively, with tech leading, hinting at a potential Santa Rally — albeit within a narrow range and mixed breadth environment.

✔ Inflation Trends = Rate-Cut Optimism

Softer inflation catalyzed rally behavior, reaffirming market expectations that the Federal Reserve is done tightening and may ease further next year.

✔ Macro Data Remains Confounding

Conflicting economic indicators — from jobs metrics to retail sales — are contributing to heightened positioning uncertainty as firms and traders try to price risk heading into 2026.

✔ Insider Moves Matter

In an environment where institutional positioning can mask true confidence levels, the concentrated insider buying in TPVG adds an interesting micro-cap dynamic to your watchlist — even as consensus price targets remain subdued.

✔ Global Markets Still Singing a Bullish Tune

International strength — from the FTSE to emerging markets — reinforces that risk assets broadly are supported, not just U.S. equities.

Insider spotlight of the week…#TPVG

Here is a snapshot of last week’s recent insider activity…

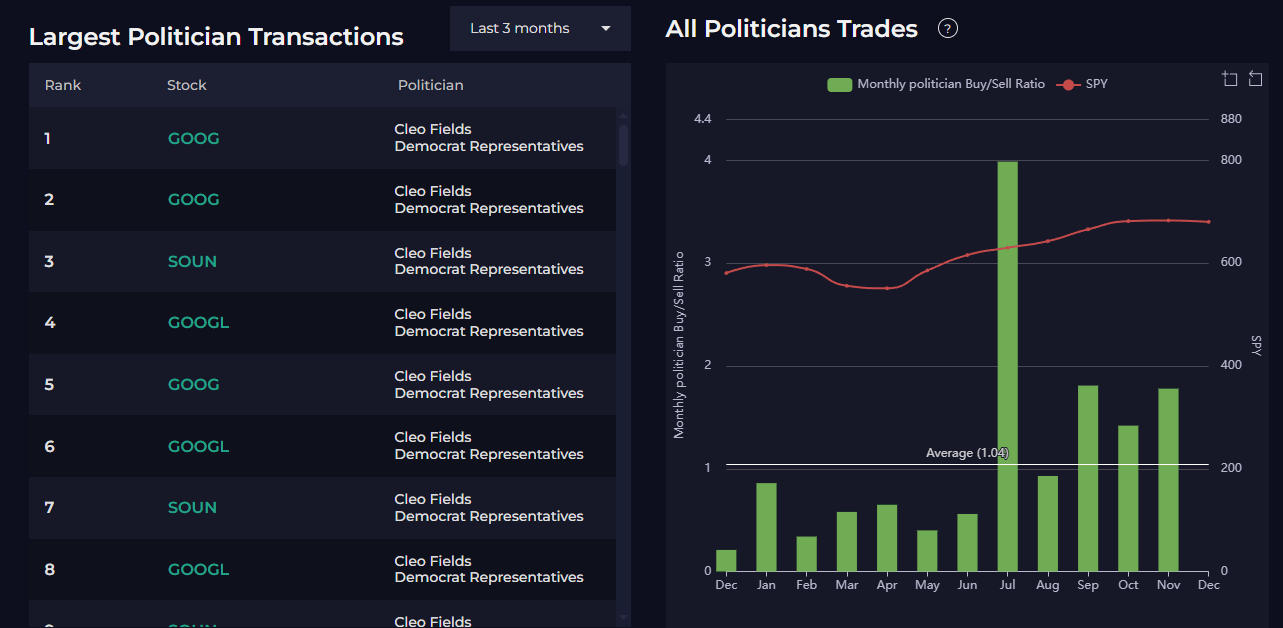

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’