- Insider Authority

- Posts

- 👀 Pilgrim loads the boat on Sable

👀 Pilgrim loads the boat on Sable

Markets were bulled up after this week's CPI inflation print....we've added some new names to our portfolio including following Pilgrim Global's massive #SOC purchase

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending Oct 24, 2025

The S&P 500 climbed about +1.1% on Monday, pulling within ~0.3% of its all-time high.

The Dow Jones Industrial Average hit a new record, aided by strong earnings from names like 3M, Coca‑Cola and a blow-out from General Motors (+14.9%).

Tech saw mixed results: while Apple surged on strong iPhone demand (+3.9%),

Underneath the surface: Credit concerns and bank / regional-bank jitters bubbled again, pushing flows into safe havens like gold (which hit fresh highs) and bonds.

Top take-away: The “bull run” remains intact for now, but signs of fatigue & rotation are present. Watch support levels closely (for example: S&P breaking the trend channel).

🔑 Key Drivers

Bank-stress scare: Worries flared around regional lenders’ bad-loan exposure and credit risks — European banks took a hit too.

Trade affair redux: Easing rhetoric between the U.S. and China helped soothe nerves and lift risk assets late in the week.

Rotation/relief rally: With some of the upside locked in, investors shifted toward beaten-down corners — but tech and high-valuation names remain under pressure.

Fund flows bounce-back: Equity funds saw a return of inflows (over $1 billion+) as optimism about rate cuts and earnings kicked in.

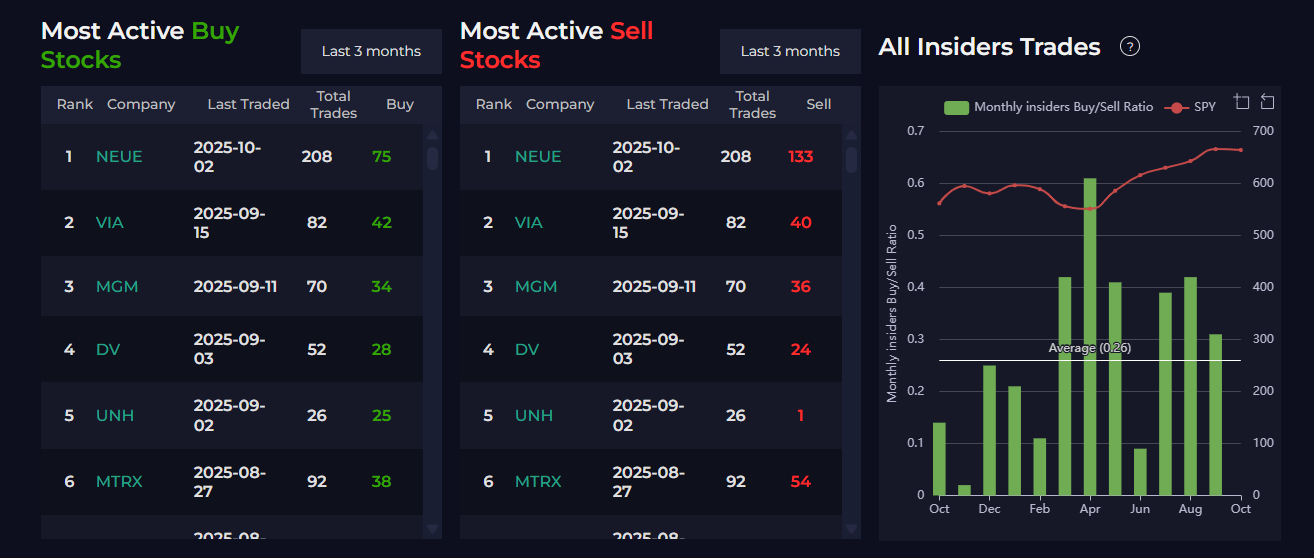

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

🧭 Key Takeaways & What to Watch

Earnings Drive the Move — The rebound shows markets are still rewarding companies that beat expectations rather than just trading on macro buzz.

Breadth Matters — While indexes are at highs, the drop in participation raises caution: major caps are leading, smaller stocks lagging.

Risk Hasn’t Disappeared — Trade war flare-ups, credit worries, and valuation fatigue are real; this isn’t a “clear-sailing” environment.

Defensive Rotation = Setup Opp — With flows shifting into safer assets and sectors, selective setups (especially mechanical ones) may present better risk-reward.

Systematic Edge Matters More Than Ever — In a market showing cracks under the surface, a mechanical, rule-based process helps manage risk and maintain discipline.

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’