- Insider Authority

- Posts

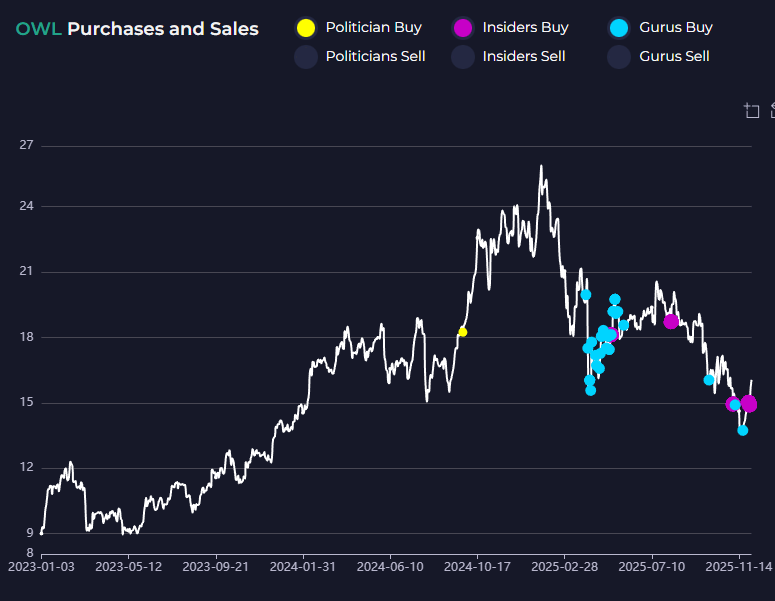

- 👀 Rotation Rises, Tech Rests — and OWL Insider Buying Steals the Spotlight

👀 Rotation Rises, Tech Rests — and OWL Insider Buying Steals the Spotlight

Markets cooled but stayed resilient this week, with stocks digesting November’s monster run while investors brace for next week’s CPI and Fed decision. Sector rotation picked up as money moved out of mega-cap tech and into financials, industrials, and energy — a sign of healthier market breadth. Beneath the surface, insider activity at OWL turned heads after notable executive buying signaled confidence in the firm’s 2026 outlook. Volatility may be quiet for now, but the setup into year-end remains surprisingly constructive.

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending December 5, 2025

Stocks cooled slightly after last week’s surge, but the broader market held firm. The S&P 500 slipped ~0.4%, Dow edged down ~0.2%, and the Nasdaq dipped ~0.6% as traders took profits ahead of next week’s economic data.

Small caps were mixed: the Russell 2000 hovered near flat, consolidating after a strong two-week run.

Despite the mild pullback, markets remain near multi-month highs, supported by improving economic tone and stable yields.

🔑 Key Drivers & Dynamics

Calmer rates after a sharp rally.

Treasury yields eased only slightly this week after November’s big decline, offering a more neutral backdrop as traders wait for next week’s CPI and Fed meeting. Rate-cut odds remain a central theme.

Profit-taking in mega-cap tech.

After outsized gains in AI, semis, and cloud names, large-cap tech saw rotation into industrials, financials, and defensives. This helped stabilize overall market breadth despite Nasdaq softness.

Mixed economic data, but no red flags.

PMI readings, employment indicators, and consumer-spending signals were all “good enough” to support a soft-landing narrative — not too hot to push yields higher, not too cold to trigger recession fears.

Energy rebounded; commodities stayed firm.

Oil found buyers after weeks of heavy selling, and copper stayed elevated on strong global demand signals — helping lift materials and select cyclicals.

🧭 Key Takeaways

Healthy consolidation after a strong November.

This week’s minor pullback didn’t damage sentiment — instead, it showed that markets are digesting gains rather than reversing trend.

Soft-landing expectations remain the anchor.

As long as inflation readings stay tame and employment stable, the door to mid-2026 rate cuts stays open — a key support for equities.

Rotation = a sign of market maturity.

Seeing money move from mega-cap tech into financials, industrials, and energy suggests a more balanced market that isn’t dependent on a single sector.

Volatility paused, not gone.

With CPI and the Fed on deck next week, traders are bracing for sharper intraday moves — especially in rate-sensitive sectors.

Seasonality still favors the bulls.

December is historically one of the strongest months for equities, and positioning remains supportive heading into the final stretch of the year.

Insider spotlight of the week…#OWL

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’