- Insider Authority

- Posts

- 👀 Selling my ABC's

👀 Selling my ABC's

What a week: still choppy ... still rising. While headline risk spiked, the market somehow pulled off a win. The CEO of Alphabet Inc. sold 32,500 shares of Alphabet at about $250.15 per share, for a total of around $8.13 million...

Good afternoon and happy Sunday! Here is a quick market rundown and an ‘inside’ peek behind the curtains of what C-Level Execs, Wall St. Hedge Fund Gurus, and politicians are trading right now…!

📊 Market Recap — Week Ending Oct 17, 2025

The S&P 500 rose ~0.5% on Friday and ended the week in the green, despite earlier turbulence.

The Dow Jones Industrial Average and Nasdaq Composite each gained around 0.5% Friday; the Nasdaq led with roughly ~2.1% for the week.

Amid the rally, volatility still lurked: fears over regional-bank loan losses & trade tension kept traders jittery.

🔑 Key Drivers

Bank-stress scare: Worries flared around regional lenders’ bad-loan exposure and credit risks — European banks took a hit too.

Trade affair redux: Easing rhetoric between the U.S. and China helped soothe nerves and lift risk assets late in the week.

Rotation/relief rally: With some of the upside locked in, investors shifted toward beaten-down corners — but tech and high-valuation names remain under pressure.

Fund flows bounce-back: Equity funds saw a return of inflows (over $1 billion+) as optimism about rate cuts and earnings kicked in.

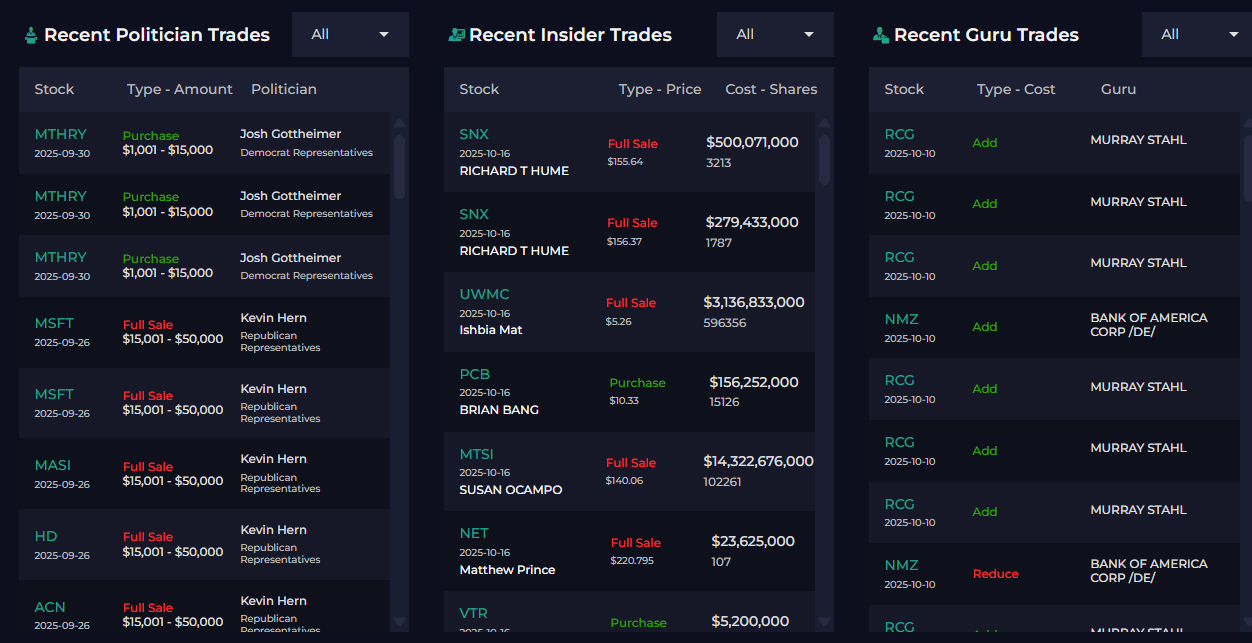

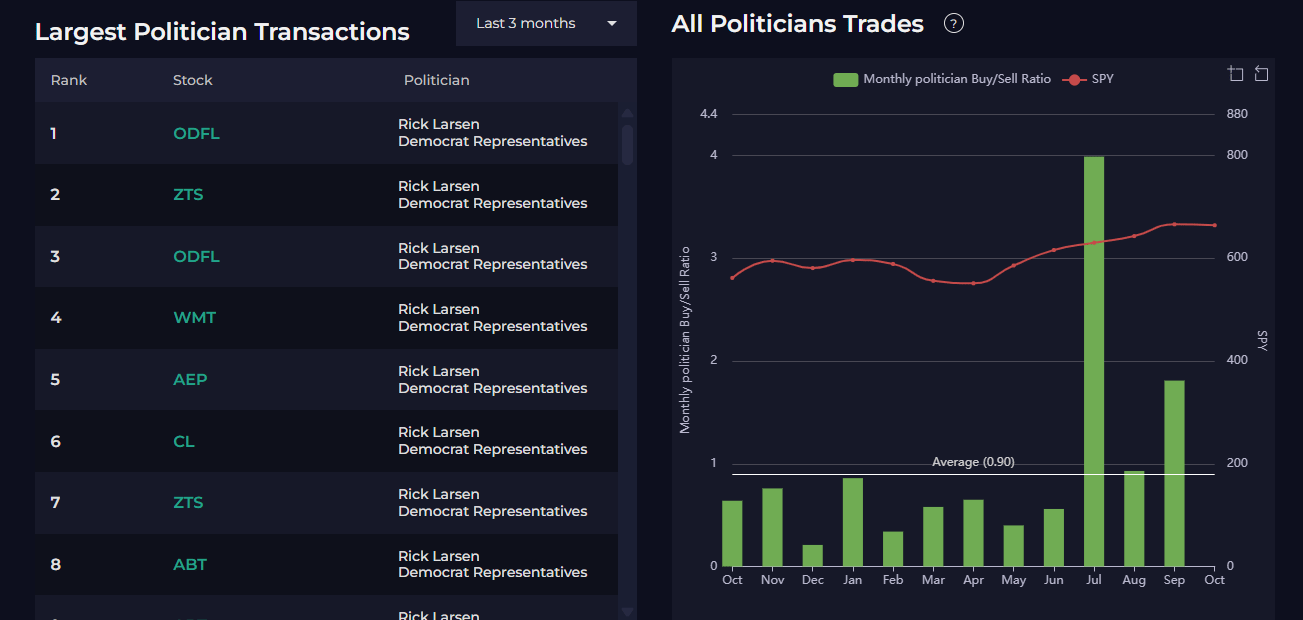

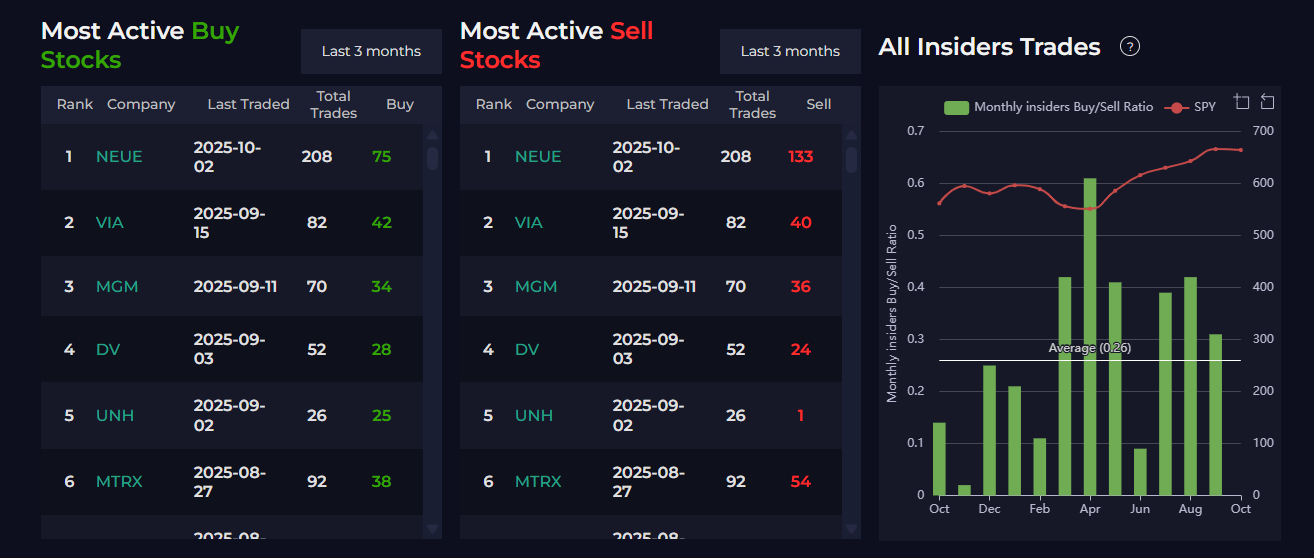

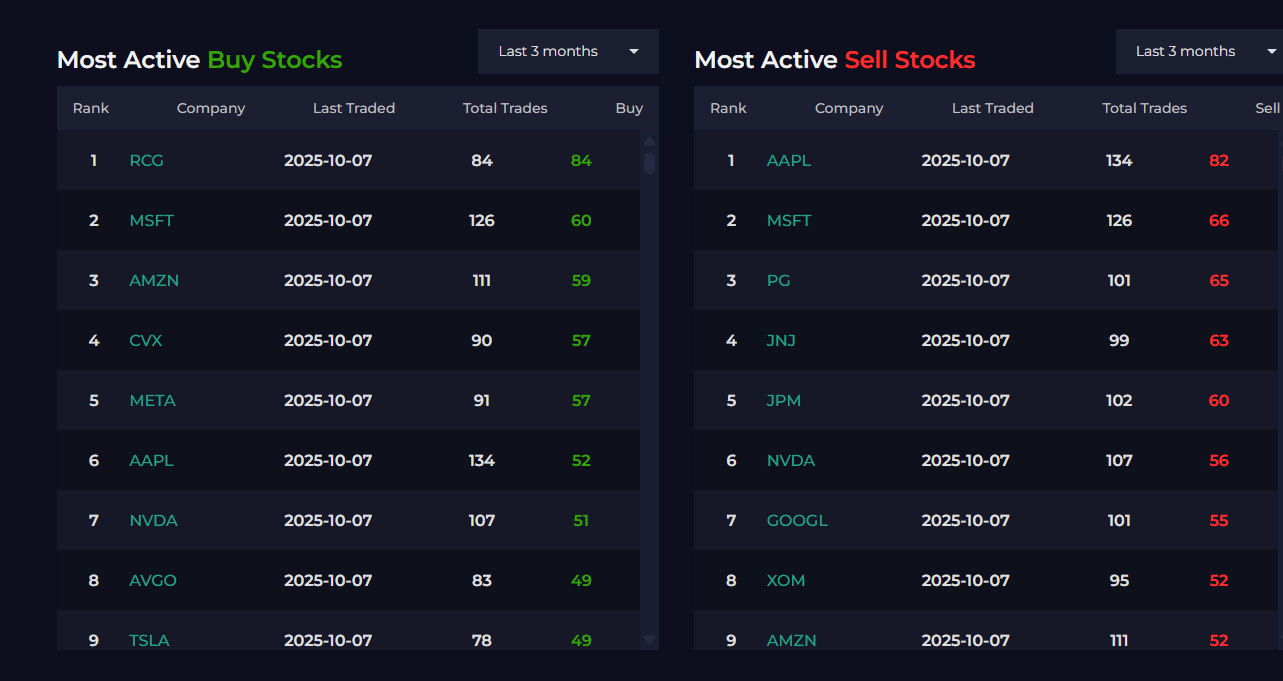

Here is a snapshot of last week’s recent insider activity…

Politicians

C-Level Execs

Hedge Funds

🧭 Key Takeaways & What to Watch

Green + shaky = resilience: Despite jitters over credit and trade, the market finished up — a sign that risk appetite remains intact.

Insiders mostly selling, not buying: When large sales dominate, especially among executives and fund holders, it often signals “harvest time” rather than fresh conviction.

Fewer massive buys = fewer confident rallies: Big insider buys are rarer — when they surface, they deserve spotlighting.

Watch the under-surface shifts: Tech/growth under pressure; financials + banks volatile; trade/credit risks active. Rotation may be quietly in motion.

Volatility remains a companion: The scare factors haven’t gone away — bank credit, trade headlines, valuations all still in play. Stay nimble.

👉 Want direct access to all insider moves — including U.S. stocks, politicians, hedge funds — in real time? Our Elite Insider Dashboard surfaces high-signal trades as they hit the tape. Stay ahead of the herd.

Want to learn how to leverage INSIDER TRADING ACTIVITY to potentially beat the market?

Look no further than ELITE INSIDER (EI) — a complete ‘all in one’ software dashboard and scanner that tracks the political, corporate, and hedge fund insider trading activity.

EI includes cluster buying, largest trade and most active trade scanners, interactive charting + data suite and our Insider Portfolio Alerts (IPA). It’s time to bridge the gap from main street to Wall Street by following smart money insiders.

See you on the ‘INSIDE.’