- Insider Authority

- Posts

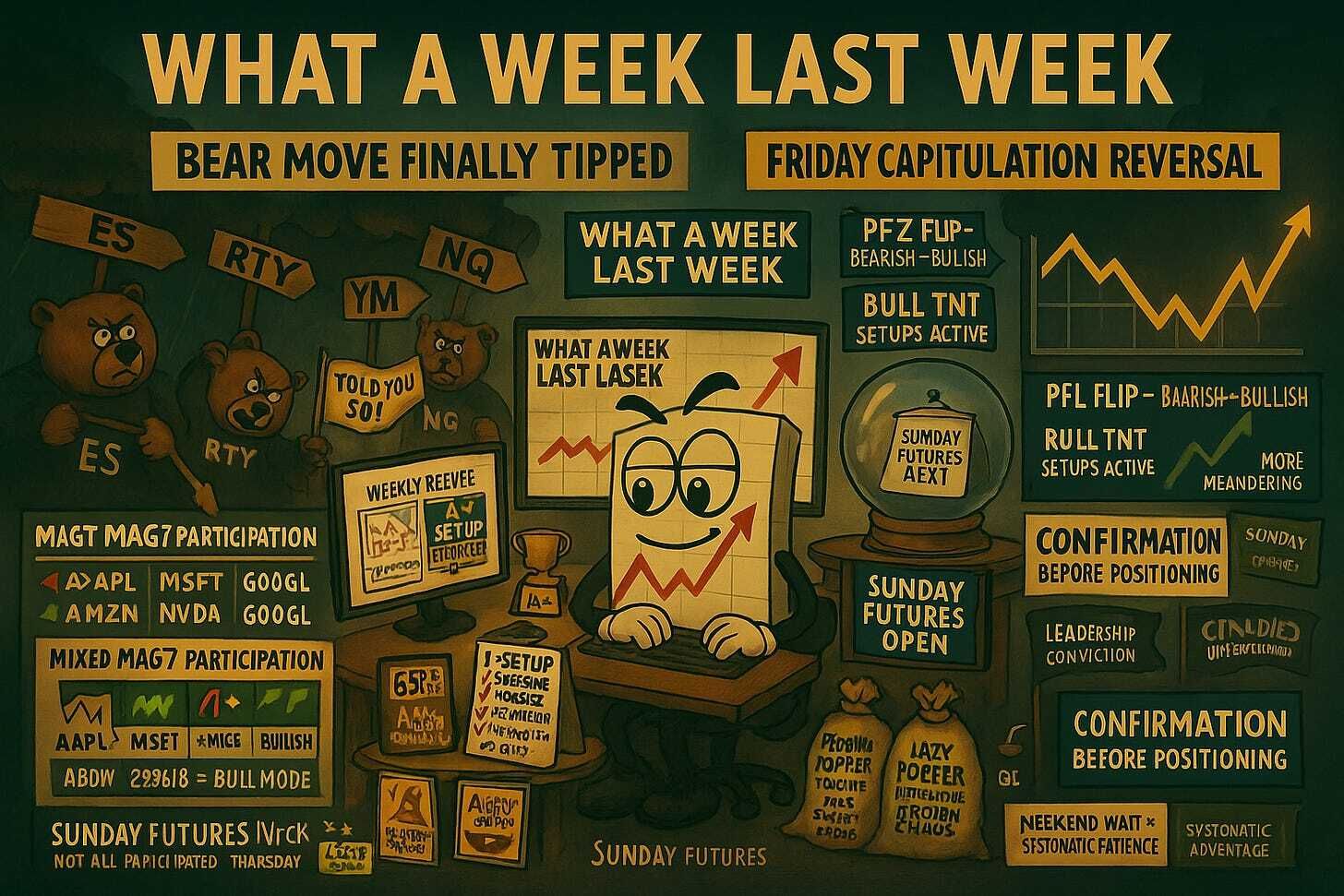

- What A Week. Bear Move Finally Tipped. Friday Capitulation Turnaround. Tag ‘n Turn Flipped Bullish. | SPX Market Briefing | 10 Nov 2025

What A Week. Bear Move Finally Tipped. Friday Capitulation Turnaround. Tag ‘n Turn Flipped Bullish. | SPX Market Briefing | 10 Nov 2025

Friday Capitulation: “Holy Bearish Batman” → “Markets Only Go Up” Intraday

What a week last week.

The bear move finally tipped over across all pairs and markets. The major indexes took a hard charge, though not all of the Mag7 participated in either the bull or bear moves.

Friday saw the capitulation of that move with yet another intraday turnaround – moving from “holy bearish moves Batman” to “feeling, the markets only go up.”

Over on the usual Tag ‘n Turn setups, the SPX and RUT flipped from their bearish breakouts and targets being reached to bullish swings going into the weekend.

Keep scrolling for last week’s wild ride breakdown…

Bear Move Tipped. Friday Reversed. Systems Flipped Bullish. Weekend Wait.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing:

Last week delivered as bear move finally tipped across all pairs and markets (Mag-7 mixed participation, Mag-3??), Friday capitulation created intraday turnaround from holy bearish Batman to markets-only-go-up feeling, SPX & RUT Tag ‘n Turn systems flipped from bearish breakouts hitting targets to bullish swings into weekend, whilst writing on weekend waiting for Sunday futures open to provide directional clues for coming week.

Current Multi-Market Status (Friday Close):

ES: 6765.00, flipped to bullish swing after hitting bear target

RTY: 2444.4, flipped to bullish after reaching downside target

YM: 47,155, participated in bear then bull intraday Friday

NQ: 25,226.75, mixed participation throughout week

CL: $59.84, finally broke below $60 psychological level

GC: $4007.8, pushed above $4000 mark

VIX: 19.08, elevated but declining from week’s highs

2yr Bonds: 3.560%

What A Week Last Week

What a week last week.

This is the systematic trader’s weekly review moment. Not predicting next week. Not forecasting direction. Just observing what happened and noting where systems now stand.

Last week delivered:

Bear move finally tipping across pairs and markets

Mixed Mag-7 participation (Mag-3)

Thursday’s A+ setup textbook execution (6 for 6 by lunch)

Friday’s dramatic intraday capitulation reversal

Tag ‘n Turn systems flipping from bearish to bullish

The week that started with “weird and funky market top behavior” ended with bearish targets hit and bullish swings into the weekend. That’s market behavior during inflection points: dramatic, whippy, emotional.

Current Status: Weekly review complete, bear targets reached, systems flipped bullish into weekend

Bear Move Finally Tipped – Mag3 Participation

The bear move finally tipped over across all pairs and markets.

After weeks of meandering at support, testing prior NATHs, 3 of 4 indexes back inside ranges – the bear move finally committed. Tipped over. Followed through.

Wednesday’s newsletter discussed Mag7 leaders tipping over. Thursday showed textbook A+ setups. Friday delivered the capitulation move that confirmed: Bears got their targets.

The major indexes took a hard charge:

ES pushed lower hitting bearish targets

RTY led the charge (as Uncle Russell does)

YM and NQ participated in downside

All pairs showing coordinated weakness

Though not all of the Mag7 participated in either the bull or bear moves.

This is worth noting: The narrative around “Mag7 tipping over” wasn’t completely accurate. Some participated in the bear move. Others didn’t. Some recovered Friday. Others stayed weak.

Mixed participation visible in charts:

AAPL, MSFT showing red weakness continuing

AMZN, NVDA, GOOGL showing green recovery

META bouncing from prior lows

TSLA and NFLX ranging without clear commitment

Not unified tipping. Mixed participation.

This matters for systematic analysis: When leadership is divided, markets lack clear conviction. Some names follow narrative, others don’t. Creates choppy whipsaw environment even when indexes commit to direction.

Current Status: Bear move tipped across indexes, Mag7 showed mixed participation not unified weakness, lack of leadership conviction noted

Friday Capitulation – “Holy Bearish Batman” to “Only Go Up”

Friday saw the capitulation of that move with yet another intraday turnaround.

“Capitulation” – the moment when the last sellers panic out, creating the conditions for reversal. Friday delivered textbook capitulation behavior.

The intraday journey:

Morning: “Holy bearish moves Batman” – gaps down, selling pressure, bear targets being reached, panic visible

Afternoon: “Feeling, the markets only go up” – reversal off lows, aggressive buying, intraday V-bottom, weekend positioning

This is classic capitulation psychology:

Bears push hard reaching final targets

Last sellers panic out at lows

Buyers step in aggressively

Intraday reversal creates confusion

Weekend positioning shifts from bearish to uncertain

Not saying bull trend confirmed. Just noting: Friday’s price action showed capitulation characteristics. Bear targets hit. Aggressive reversal from lows. Mixed signals into weekend.

Systematic traders don’t predict what Monday brings. We note: Friday’s intraday reversal created uncertainty. Bears hit targets but couldn’t hold lows. Bulls showed up aggressively but haven’t confirmed reversal yet.

Current Status: Friday capitulation move from bearish panic to aggressive buying reversal, neither side confirming control yet, weekend positioning uncertain

Tag ‘n Turn Flipped: Bearish Breakout → Targets → Bullish Swing

Over on the usual Tag ‘n Turn setups, the SPX and RUT flipped from their bearish breakouts and targets being reached to bullish swings going into the weekend.

This is mechanical system behavior worth highlighting.

The sequence:

Phase 1: Bearish breakout

SPX and RUT broke down from range support. Tag ‘n Turn systems triggered bearish positioning. Targets established based on breakout levels.

Phase 2: Targets reached

Thursday/Friday action pushed price to bearish targets:

SPX: 6763.80 target zone reached

RUT: 2391.0484 target zone approached

Phase 3: Bullish swing into weekend

Friday’s capitulation reversal triggered Tag ‘n Turn flip:

SPX: Flipped to bullish above 6640.93 (PFZ Level 6631.44)

RUT: Flipped to bullish above 2396.18 (PFZ Level 2380.07)

This is systematic mechanical behavior. Not prediction. Not discretionary judgment. Just: Bearish target hit → reversal action triggered → bullish swing signal generated.

What this means going forward:

Tag ‘n Turn systems now positioned bullish into weekend. If Sunday futures open confirms bullish continuation, mechanical entries trigger. If futures gap down negating bullish flip, systems adjust.

The advantage: No emotional attachment to direction. Just mechanical response to price action.

Charts visible: Both SPX and RUT showing PFZ Flip signals, Bull TnT setups marked, reversal targets identified (SPX 74pts to 6920.21 NATHs).

Current Status: Tag ‘n Turn flipped from bearish breakout to bullish swing after targets hit, mechanical systems positioned for potential upside, confirmation required from Sunday futures

Weekend Wait – Sunday Futures Hold Clues

This is the systematic trader’s acknowledgement: We’re in between sessions. Can’t trade. Don’t know yet.

Sunday night futures open provides first clues:

If futures gap up / open strong:

Friday’s capitulation reversal validated. Potential run toward 6920.21 NATHs on SPX. Mechanical bullish setups trigger.

If futures gap down / open weak:

Friday’s reversal was short-covering into weekend. Bear move resumes.

If futures open flat / uncertain:

More meandering. More whipsaws. Range-bound action continues. Premium collection strategies appropriate.

This is systematic patience in action: Not predicting. Not positioning before confirmation. Just waiting for price to show direction, then responding mechanically.

Last week delivered bear targets. Friday delivered capitulation reversal. Tag ‘n Turn flipped bullish. Sunday futures will confirm or negate. Then mechanical rules trigger appropriate positioning.

Current Status: Weekend wait for Sunday futures open, three scenarios possible (gap up bullish / gap down bearish / flat uncertain), mechanical positioning awaits confirmation not prediction

Trade well,

T2 Markets

p.s. Want full access to the SPX Income System(includes 7 mechanical income strategies)? Join our team now!

p.p.s. Want funding to DAY TRADE our options strategies? Discover how you can start trading with up to $250k of RISK FREE capital!